Most people today are experiencing big financial problems because they simply do not know how to budget their expenses. They do not know how much they are spending. While most people know how much they are making, many do not know how much they are spending. Having a budget is an absolute must if you want to pay down your debts or take control of your expenses, grow financially, and invest more wisely.

I have always said that if you want to grow your money, you need to invest in multiple sources of income specially the sources that work for you without exchanging your time for money. You need to begin by investing 10% of your income and over time, you grow financially by eventually investing 90% of your income while only spending 10% of your income. This is because your money and income are increasing and you no longer need the majority of it for living.

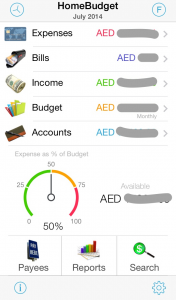

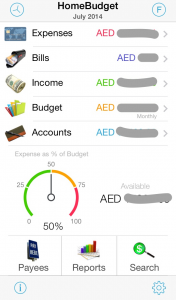

The majority of middle class people today are living on between $1,000 and $10,000 per month. Regardless of how much money you make, it is important to budget your money. I use an app called Home Budget, which is a paid app, for budgeting my own money. This is actually the most used app on my iPhone because I use it to plug in whatever expenses I have. Whether it is buying cinema tickets, paying the check at a restaurant, or spending money on anything else, I just log it and enter the expense.

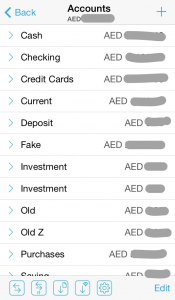

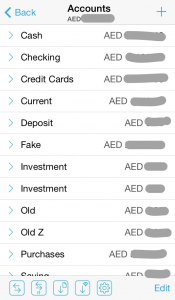

This app also allows you to create different accounts. For instance, you can use it to create accounts for your different credit cards, personal accounts, investment accounts, etc. When you spend money, you just enter the expense in the account where the money went out, sometimes you pay money on behalf of your business also you can input that in the app so you will not forget how much you have paid on behalf of your company, the app will show you how much balance in each account or credit card is left and so many other details that gives you a clear understanding of your personal and business financial situation so you can take the right decisions and control your business and life in a wiser way.

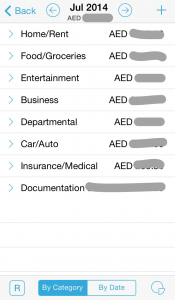

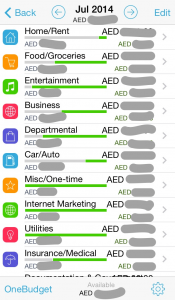

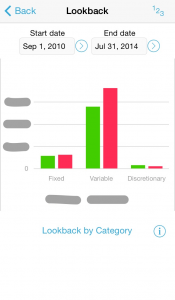

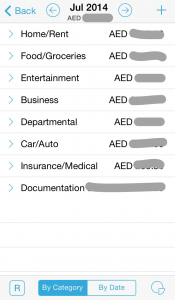

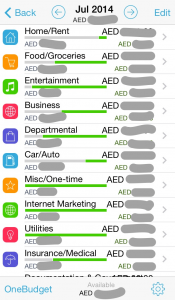

You can also set up categories for money you spend, such as rent, groceries, auto, insurance, medical, business, etc. Home Budget allows you to set up as many categories as you want and add some logos for each category so you can differentiate it from other categories.

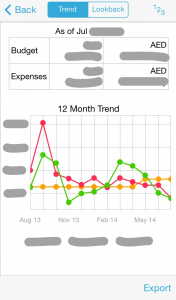

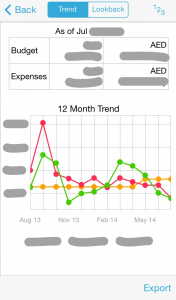

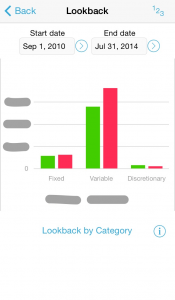

It’s very easy to use and you just plug in whatever amount you spend into the proper category or input the income that you have received into any of your accounts. There is also a calculator that you can use to assist you, which can be helpful for exchange rates. When you pull up the app to enter an amount, it automatically goes to today’s date, you select the correct category and the account from which the money came. You also have the ability to add notes regarding what you are spending, which makes it easy to remember certain items plus you can see and compare different monthly reports to track your financial performance and cash flow.

Additionally, you can split expenses. For example, suppose you want to pay three months of rent in advance and you want to divide the expense over those three months for budgeting purposes, the app will split the expense for you. Also, the app has a section for bills that you can place on the calendar and pay from the correct accounts automatically. I can even enter due date for bills, such as my credit cards, so I know when those payments are due. There is also a section for income where you can enter income when it is received or you can make it automatic, which can be helpful if you have payments that come in automatically. It will also allow you to enter cash as income.

One of the great aspects of this app is that you can see how much income you have and how much you have spent. The target budget section of the app allows you to budget monthly for certain expenses and then you can confirm how much you have for expenses versus your income, so you know how much you have left to spend.

You can even have sections for different accounts so that you can shift money between accounts, such as a cash account and an investment account. If you need to do so, it will also allow you to extract expenses onto an Excel spreadsheet. Another great option is the ability to have a list of payees. This app will also allow you to review reports for different months and even surf for certain expenses. One of the ways in which I use this app is to track my accounts, especially for my business and know how much money I have to plan the coming bills.

As you can see, Home Budget offers a lot of different functions, which is why it is the most used app on my iPhone. It allows me to merge my entire financial system and understand how to schedule cash flow and how to stay on track with my budget. I highly recommend this app, particularly for anyone who wants to be more organized financially and make wise decisions.

Please share with us the tools and techniques that you use to budget your finances and cashflow.